- Position:

- Home

- English Home

- Investor Relations

- Management Policy

- Japan Post Group Risk Management

Japan Post Group Risk Management

As part of our risk management efforts, we are promoting a three-pronged approach to minimize the impact of risks, prevent crises, and identify any manifestations of risk. This we will do by strengthening our control of risks that could have a significant impact on the Japan Post Group's business. These risks include emerging (unknown) risks, such as those related to conduct. Furthermore, we will set up a system to prevent risks that could have a significant impact on the Group from materializing, and speed up reporting to management when risks do occur.

In addition, by integrating risk management and crisis management functions, a smooth transition to crisis management can be achieved whenever risks materialize.

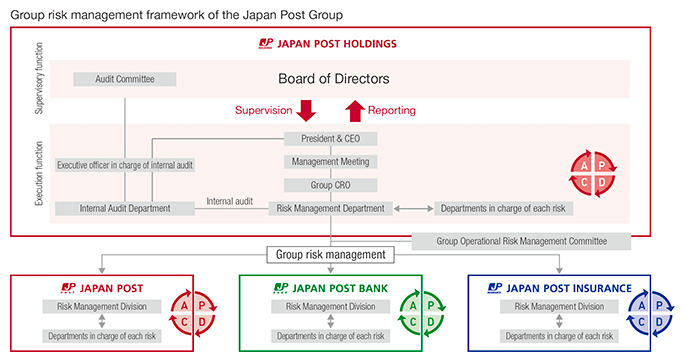

To strengthen Group governance, Japan Post Holdings has appointed a Group chief risk officer from among its executive officers. This individual reports to, and is supervised by, directors and others regarding the Group's risk management and its initiatives. The Group Risk and Compliance Committee, which comprises executives in charge of risk management at each Group company, shares information and discusses risk management to improve the risk management of each Group company.

Each Group company has designated a department to oversee its own risk management, and each department identifies, assesses, controls, and monitors their risks in accordance with its own business characteristics, and has established a risk management framework according to which it reports to Japan Post Holdings as necessary.

Through the implementation of the above initiatives, we will improve risk management and ensure the Group's sustainable and sound management.

Risk Appetite Framework (RAF)

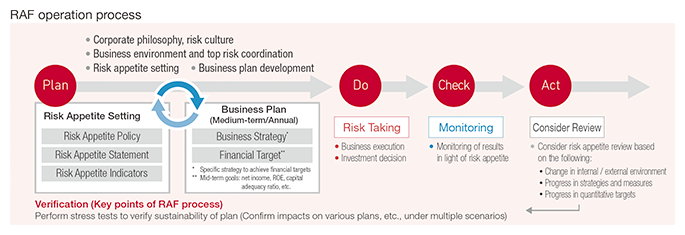

The Japan Post Group has introduced its Risk Appetite Framework (RAF) from the fiscal year ended March 31, 2022, as a framework to control risks for the entire Group by clarifying the type and amount of risks (risk appetite) to be taken or accepted in order to expand earnings.

Utilizing this framework, the Japan Post Group will approve the risks and types of risks to be taken by its management together with

the business plan, and aims to enhance corporate value by avoiding unexpected losses, improving the risk-return balance, and ensuring

accountability.

Approach to risk by area of business

Financial business (Japan Post Bank, Japan Post Insurance)

We aim to secure profits while maintaining financial soundness through appropriate risk-taking and risk control in asset and liability management (ALM), investment operations, and insurance underwriting.

Non-Financial business (Japan Post Holdings, Japan Post)

In the areas of postal and domestic logistics, real estate, and new businesses, we seek to secure new earnings. At the same time, we will consciously remain financially sound by making sure we take only appropriate risks and make sure they remain within the scope of defined capital projects, to the exclusion of financial and existing areas of business.

Management of critical risks

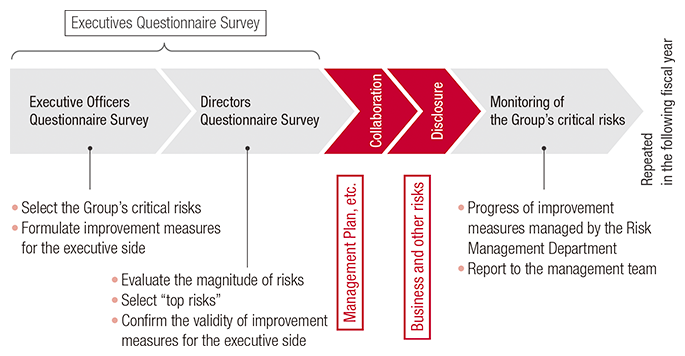

Every year, Japan Post Holdings reviews risks that may be critical, meaning they would have a significant impact on areas of the Group's business. Such impact would derive from factors including changes in the external environment and in business strategies.

After identifying and evaluating specific risks, we formulate measures to prevent or remedy said risks. They are based on the results of the Executives Questionnaire, distributed to directors and executive officers. Based on the improvements indicated, the management team sets in motion the four-step, Plan-Do-Check-Act management cycle to ensure continuous improvement in the Group's processes and products.

Top risks*

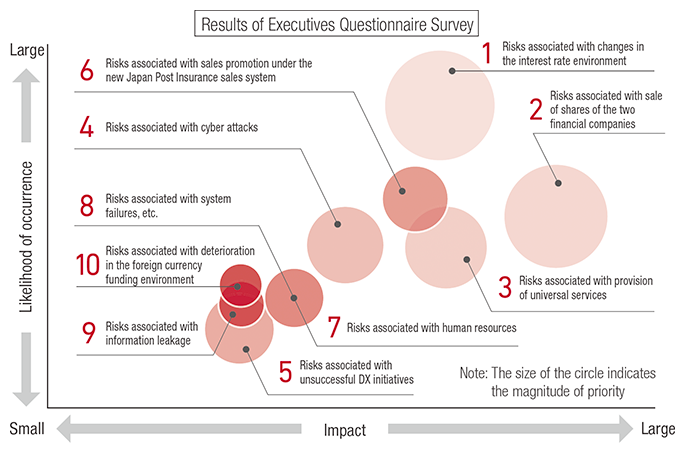

Based on the Executives' questionnaire, Japan Post Holdings discloses risks that are considered to be of particularly high priority in terms of the likelihood of occurrence and impact on Group performance.

The risks, noted in the Business and Other Risks section of our securities report are described as top risks. In other words, they are considered risks to the Group's business and other activities that are of particular importance to management.

* Risks facing the Group are not limited to the above; please refer to our securities report for further details.

Note. The size of the circle indicates the magnitude of priority.

FY2025 Top Risks, Main Scenarios

| Top Risks | Main Scenarios | |

| Financial and strategic risks | ||

| 1 | Universal services | Despite efforts to improve profitability and operational efficiency, costs associated with maintaining universal services are rising, due to inflation and other changes in the business environment. |

| 2 | Postal and domestic logistics | A significant decrease in the Group's earnings has resulted from a decrease in mail volume. This follows advances in digitization; weakness in revenues from parcel-post and other areas, in the wake of intensified competition and the expansion of the e-commerce market. An additional cause is the failure of initiatives to strengthen the competitiveness of Japan Post. |

| 3 | Sales of financial products | Success has been lacking in the areas of insurance products and investment trusts handled by the Group, as well as for new-product development and sales activities focused on customer convenience. With sales performance slack, the Group's earnings have seen a significant decrease. |

| 4 | New business areas, capital alliances, business alliances, M&A | There has been a significant decrease in the Group's earnings due to its inability to grow in new areas of business and obtain benefits from capital and business alliances, and realize impairment losses related to investment businesses. |

| 5 | Business environment shifts from deflation to inflation | The Group operates numerous post offices and employs a large number of people. Related expenses rise when international conflicts cause a sudden increase in fuel prices, and the ongoing depreciation of the yen results in rising domestic prices. |

| 6 | Sale of Japan Post Bank, Japan Post Insurance shares | Customer attrition has become evident. This has resulted from such factors as losses from the sale of shares of the two financial companies; an inability to secure alternative revenue sources; and/or the difficulty in conducting integrated, Groupwide business operations following a declining equity stake in the subsidiaries. At the same time, there has been a weakening of brand power, causing a significant decrease in the Group's earnings. |

| Operational Risks | ||

| 1 | Human resources | It can be hard to retain talented human resources in various business roles, as well as talent specializing in IT. Personnel and labor issues can render the Group unable to provide rewarding work, as human resources become adversely affected by losses or shortages, while personnel costs spiral ever higher. This may be compounded by a loss of competitiveness. |

| 2 | Cyber attacks (security vulnerabilities) | It is possible that attacks on Group systems or unauthorized use of services result in a broad, prolonged suspension of business. Yet, if customer service is inadequate, the Group's social credibility will be damaged. |

| 3 | Legal and regulatory violations | Compliance with laws and regulations, as well as preventive measures may be ineffective. This can result in legal and regulatory violations that affect the Group's business operations, damaging its social credibility. |

| 4 | Business continuity in the event of a major disaster | Wide-ranging natural disasters, epidemics, and other serious disruptions of the social infrastructure can result in damage to stores and other facilities. Such a situation would require that compensation be paid for customer losses, and lead to circumstances requiring significant amounts of time and financial outlays. |