- Position:

- Home

- English Home

- Investor Relations

- Management Policy

- Japan Post Group Compliance

Japan Post Group Compliance

The Japan Post Group (hereinafter, "the Group") recognizes compliance as one of its foremost management priorities. In order to enhance our corporate value, we focus on promoting compliance management for earning trust from our customers, stakeholders, local communities and society, and enhancing operating foundation as the bases for realizing the Group's management philosophy and sustainable growth."Compliance" means that all [executive] officers and employees, based on our management philosophy, not only comply with laws and regulations but also act in ways that meets the expectations of our customers, local communities, society, shareholders, and other stakeholders.

Each Group company works to improve services so that customers can use with peace of mind by establishing effective compliance systems while giving due consideration to the public nature of businesses, and ensure customer-oriented operations by innovating compliance risk management based on a risk-based approach.

Concurrently, the Group strengthens the Group compliance functions by periodically holding the Group Compliance Committee meetings, and secures transparency of management by appropriately disclosing the status of the promotion of the Group's compliance management.

Japan Post Group Compliance System

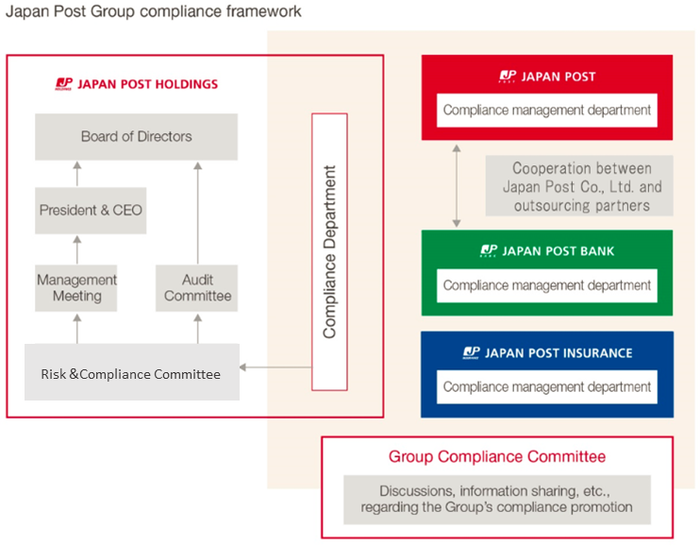

Each Group company establishes a compliance management department to conduct integrated management of compliance-related matters. The compliance management department is established under the director in charge of compliance to conduct planning and management of promoting compliance. Promoting compliance policy and measures and other related issues are discussed by the Compliance Committee that provides advice to its Management Meeting. The director in charge of compliance reports important matters discussed by the Compliance Committee to the Management Meeting and the Board of Directors.

The Group Compliance Committee meetings are periodically held to share and discuss compliance-related issues and the status of progress to promote the Group compliance and further innovation the Group's compliance risk management by the risk-based approach.

Group Company Compliance Framework

Each Group company has built a compliance framework as outlined below to promote compliance.

1. Line of Responsibility for Compliance Activities

- a. Establishment of Line of Responsibility for Compliance Activities

Each Group company has a compliance management department that is independent from departments related to business execution, and organizes the line of responsibility for compliance activities by assigning a compliance officer who promotes compliance activities, and a compliance manager who is responsible for the promotion of compliance to all Head Office departments, regional offices, post offices and branch offices.

- b. Response to Compliance Violations

In the event of discovery of any information which raise suspicion of compliance violations by way of internal reporting or by other means, each Group company immediately conducts investigations mainly at the compliance management department. The presence of the compliance violation and causes of the violation are confirmed and clarified, and measures are taken to prevent their recurrence. Furthermore, each Group company ensures customer-oriented business operations by implementing measures to reduce compliance risks and reviewing the compliance framework as needed.

In the event of discovery of a material compliance violation which caused disadvantages to customers (including acts that fall under a crime), the Group makes an utmost efforts to eliminate such violations and works to prevent further expansion of damage to customers by implementing measures such as early detection and investigations and through immediate disclosure.

Since FY2020, the major types of material compliance violations which caused particular disadvantages to customers are listed below (the outline of all cases have been already disclosed).

Going forward, we will make Group-wide and unified efforts to promote compliance so that customers can use our services with peace of mind.FY2020 F2021 FY2022 FY2023

(~3Q)Number of cases of non-delivery of mails, etc. that should have been delivered 17 (3) 13 (1) 7 (0) 5 (2) Number of cases where customer's property was damaged 12 (1) 8 (2) 5 (1) 8 (2) Of the above-listed cases other than those discovered in Japan Post were one case in FY2021 and FY2022, respectively, which were attributable to Japan Post Insurance (the case damaging customers' property).

Note: The cases were counted by fiscal year based on the date on which the relevant violation was found. Figures in parentheses represent the number of violations committed by trustees.

- c. Initiatives for Protecting and Managing Customer Information Following Revisions of Laws

Under the revised Act on the Protection of Personal Information which was enforced in April 2022, it is provided that leakage of personal data which is highly likely to damage individual rights and interests shall be reported. The number of cases reported in accordance with the said law during the first quarter of FY2023 was six.

The breakdown of each fiscal year is shown in the table below.

Our preventive measures against the leakage of personal data, etc. include the prevention of loss of documents which carry our customers' personal information, etc. To that end, we focus on thorough protection and management of personal information by providing continuous guidance to employees, concurrently with promoting revision of operating procedures such as reducing documents to be stored at post offices and digitalizing paper forms (reducing paper documents).Japan Post Group Privacy Policy

Breakdown of the number of information leakages by fiscal year according to the categories set forth by the Act on the Protection of Personal Information, etc. FY2022 FY2023

(~3Q)Sensitive personal information: 20 4 Subject to property damage if wrongfully handled: 22 15 Leakage that may have been caused for wrongful purposes: 4 1 Number of individuals listed on personal data exceeds 1,000: 0 2 Total 46 22 - d. Improvement and Appropriate Operation of Internal Reporting System

Initiatives on Internal Reporting System

Click the above link for our initiatives for the internal reporting system of the Group

2. Promoting Compliance

- a. Establishment of Compliance Program

Each fiscal year, each Group company establishes a compliance program to provide a specific action plan for promoting compliance and periodically checks the status of progress.

- b. Initiatives for Compliance Items

Each Group company has decided to promote compliance by setting out compliance items to promote as a priority challenge, and establishing a department responsible for implementing each such compliance item. The compliance management department supervises the promotion of compliance conducted by such department responsible, and implements unified management of compliance promotion across the entire company.

- c. Preparation and Distribution of Compliance Manual

Each Group company prepares and distributes a compliance manual which serves as a practical guide to promote compliance, explaining the compliance framework, compliance items, and other related matters. A compliance handbook that summarizes the manual is also prepared and distributed. Both the manual and the handbook are used in training programs and other activities to raise awareness of the importance of compliance.

- d. Implementation of Compliance-related Training

Each Group company conducts a range of training activities for compliance items, including collective training and training through DVDs and e-learning, to promote a better understanding of legal matters and other areas, and to raise awareness of compliance.

From the viewpoint of eradicating harassment, we communicate top management's messages pertaining to harassment and undertake a range of initiatives, including dissemination and enlightenment for all employees, implementation of managers' training using case studies, and the distribution of booklets and other materials.

3. Initiatives for Anti-Money Laundering, Counter Financing of Terrorism, and Counter-Proliferation Financing

The importance of countermeasures against international money laundering, financing of terrorism and proliferation financing*1 (hereinafter, "money laundering, etc.") have grown to an unprecedented level, and management systems are required to properly respond to changes in the risks such as money laundering, etc. which become more complicated and sophisticated year by year.

*1 The Group positions the countermeasures against money laundering, etc. as the top priority issue of management. We have established the basic policy in line with the requests of international organizations such as FATF*2, and laws and regulations, and guidelines such as "Guidelines for Anti-Money Laundering and Combating the Financing of Terrorism" issued by the Financial Services Agency to improve the system under the leadership of the management. To that end, we clarified the roles and responsibilities of directors and employees involved in the countermeasures against money laundering, etc. by appointing the director/executive officer in charge of the compliance management department as Chief Officer for countermeasures against money laundering, etc.

Specifically, we take countermeasures based on a risk-based approach from the viewpoint of preventing the products and services provided by the Group from being misused for the purpose of money laundering, etc.

Our main initiatives for the policy associated with the countermeasures against money laundering, etc. include the followings.

- -

The Group works to address the issue of money laundering, etc. in a Group-wide effort.

- -

We have clarified the roles and responsibilities of directors and employees who are involved in the countermeasures against money laundering, etc. by appointing the director/executive officer in charge of the compliance management department as Chief Officer in charge of countermeasures against money laundering, etc.

- -

The compliance management department sets up, organizes and implements the frameworks of risk reduction measures associated with money laundering, etc. Furthermore, the Internal Audit Department verifies the effectiveness of the risk mitigation measures on a regular basis and at any time from an independent standpoint.

- -

The Group has established the organization system and internal rules to appropriately implement the countermeasures against money laundering, etc. in accordance with the relevant laws and regulations, etc.

- -

The Group implements continuous customer due diligence measures at the beginning of, and after transaction.

- -

The customer due diligence measures are carried out by checking the identification of the relevant customer, the purpose of transaction, etc., and the beneficial owner, etc. by using reliable information. The Group also checks whether or not the customers, etc. fall under those subject to economic sanctions designated by the resolutions of the United Nations Security Council.

- -

The Group implements necessary risk mitigation measures according to the level of risks of money laundering, etc. In the event that the Group is to begin transactions with a customer with a high risk of suspicious spoofing, etc., the Group takes strict measures, such as requiring approval from the chief of the department in charge.

- -

In accordance with the relating laws and regulations, etc., the Group preserves documents and records associated with the prevention of money laundering, etc.

- -

By conducting internal training, the Group ensures that all directors and employees are informed of the obligations and requirements for the prevention of money laundering, etc.

*2 Financial Action Task Force: The intergovernmental meeting established for the promotion of international cooperation in addressing the money laundering issues.

The Japan Post Group Policy on Anti-Money Laundering, Counter Financing of Terrorism, and Counter-Proliferation Financing (Japanese)[PDF:95kb]