- Position:

- Home

- English Home

- Investor Relations

- Management Policy

- Japan Post Group Risk Management

Japan Post Group Risk Management

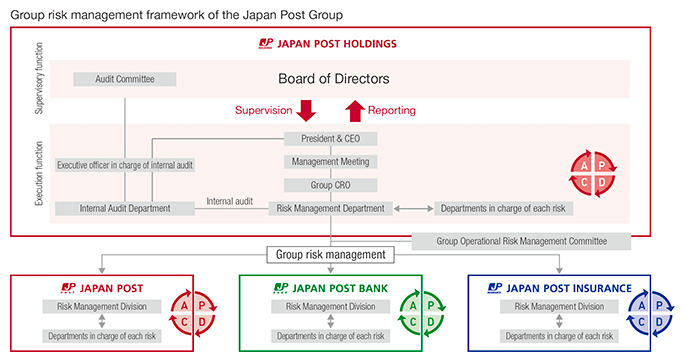

The Japan Post Group stipulates basic matters to be observed in risk management, such as risks that are to be managed by each Group company and matters to be reported to Japan Post Holdings, in the Japan Post Group Management Agreements and other documents, while Japan Post Holdings manages risks for the entire Group by monitoring the Group's risk management and its improvement.

To strengthen Group governance, Japan Post Holdings appoints the Group Chief Risk Officer (CRO) from among its executive officers who reports to and is supervised by directors and others regarding the Group's risk management and its initiatives. In addition, the Group Operational Risk Management Committee, which consists of executive officers in charge of risk management at each Group company, shares information and discuss risk management to improve risk management of each Group company.

Furthermore, each Group company has designated a department to oversee its own risk management, and each department proactively identifies,assesses, controls, and monitors their risks in accordance with its own business characteristics, and has established a risk management framework where it reports necessary matters to Japan Post Holdings.

Risk Appetite Framework (RAF)

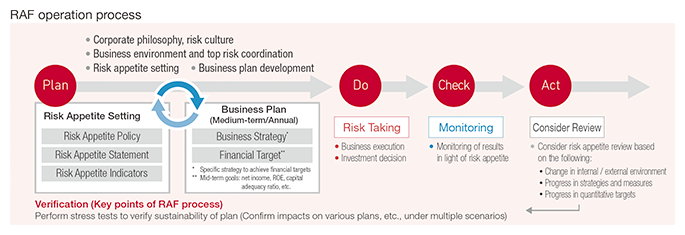

The Japan Post Group has introduced its Risk Appetite Framework (RAF) from the fiscal year ended March 31, 2022, as a framework to control risks for the entire Group by clarifying the type and amount of risks (risk appetite) to be taken or accepted in order to expand earnings.

Utilizing this framework, the Japan Post Group will approve the risks and types of risks to be taken by its management together with the business plan, and aims to enhance corporate value by avoiding unexpected losses, improving the risk-return balance, and ensuring accountability.

Basic Concept for Risk Appetite by Business

Financial Businesses (Japan Post Bank and Japan Post Insurance)

We aim to secure profits while maintaining financial soundness through appropriate risk-taking and risk control in asset and liability management (ALM), investment operations, and insurance underwriting.

Non-Financial Businesses (Japan Post Holdings and Japan Post)

In the postal and domestic logistics business, real estate business, and new businesses, we will aim to secure new earnings while maintaining financial soundness through appropriate risk-taking and risk control within the scope of capital, excluding the financial and existing businesses.

Management of Critical Risks Facing the Group

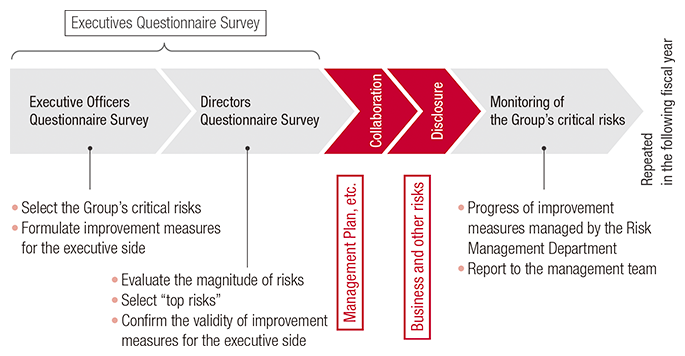

Every year, Japan Post Holdings reviews risks that may have a significant impact on the Group's business (the Group's critical risks) based on such factors as changes in the external environment and business strategies. Japan Post Holdings identifies and evaluates specific risks by conducting a questionnaire survey of directors and executive officers (Executives Questionnaire Survey) and executes a PDCA cycle, through which the management team formulates improvement measures and monitors their implementation status, among other things.

The Group's critical risks are disclosed as "Business and Other Risks" in the Annual Securities Report.

Top Risks

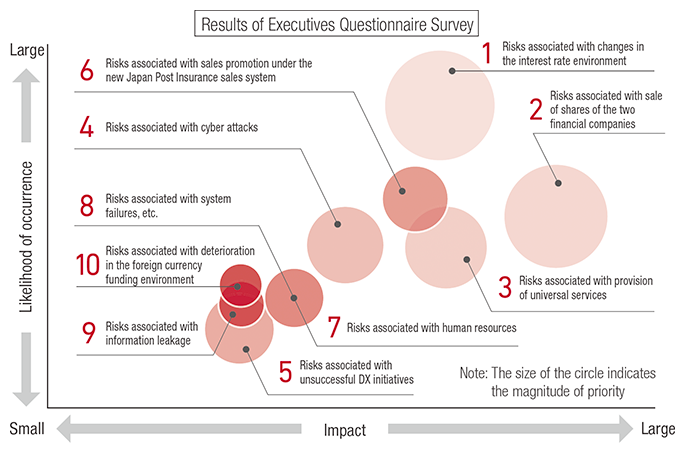

Japan Post Holdings conducts a questionnaire survey of directors and other personnel to identify "risks to the Group's business and other activities that are of particular importance to management." As a result, the Company evaluates the magnitude of risks from the perspective of likelihood of occurrence and severity of impact, and designates the most significant risks as "top risks."

In collaboration with Group companies, Japan Post Holdings monitors the management status of top risks and improvement measures.

In addition, top risks are incorporated into discussions for RAF and management planning.

Top risks and main assumed scenarios for the fiscal year ending March 31, 2024 (Business and other risks of the Group that are of particular importance to the management of the Company)

| Top risks | Main assumed scenarios | |

| 1 | Risks associated with changes in the interest rate environment | The inability of the ALM strategies of the two financial companies to respond to changes in interest rates, outfl ows and transfer of savings and other deposits, and declines in the prices of bonds held by the Group cause a significant decrease in the Group's earnings. |

| 2 | Risks associated with sale of shares of the two financial companies | Factors such as losses from the sale of shares of the two financial companies, an inability to secure alternative revenue sources replacing the two financial companies, and/or the difficulty of conducting integrated, Group-wide business operations as a result of a declining equity stake in the subsidiaries lead to customer attrition and a weakening of brand power and thereby cause a significant decrease in the Group's earnings. |

| 3 | Risks associated with provision of universal services | A failure to keep a balance between universal services and cost reduction and an inability to reassess unprofi table business results in a decline in competitiveness and efficiency, causing a significant decrease in the Group's earnings. |

| 4 | Risks associated with cyber attacks | The Group's businesses are suspended or restricted for an extended period of time due to cyber attacks or unauthorized use of various services or to delays in service restoration, which significantly impact the Group's business continuity. |

| 5 | Risks associated with unsuccessful DX initiatives | If the Group's integrated DX promotion is not successful or if the Group is unable to respond appropriately to changes in the business environment, its competitiveness and efficiency will decline and thereby cause a significant decrease in the Group's earnings. |

| 6 | Risks associated with sales promotion under the new Japan Post Insurance sales system | The measures taken to promote sales under the new Japan Post Insurance sales system are not successful and there is continued weakness in new policy acquisition and inefficiencies in the sales system, causing a significant decrease in the Group's earnings. |

| 7 | Risks associated with human resources | An inability to retain talented human resources in various business roles as well as talent specializing in IT and other roles and an inability to provide a rewarding work environment due to the occurrence of personnel and labor issues lead to a loss or shortage of human resources and higher personnel costs. This in turn leads to a loss of competitiveness and thereby causes a significant decrease in the Group's earnings. |

| 8 | Risks associated with system failures, etc. | System failures caused by inadequate system upgrades, system defects, or aging of systems results in business suspensions and disruptions. In addition, delays in service restoration after a system failure significantly impact the Group's business continuity. |

| 9 | Risks associated with information leakage | Stagnation of data governance efforts, such as appropriate management measures for post office data, and intentional information leaks by employees cause reputational risks to be realized and damage the Company's corporate value. |

| 10 | Risks associated with deterioration in the foreign currency funding environment | In the overseas investments of the two financial companies, when market liquidity deteriorates due to financial market turmoil, foreign currency funding costs rise sharply and thereby cause a significant decrease in the Group's earnings. |